Croissant

Capital

Croissant Capital helps brands and retailers unlock growth without the burden of traditional financing.

Croissant Capital helps brands and retailers unlock growth without the burden of traditional financing.

Instant, non-dilutive funding—backed by the spending power of your future customers.

Created by operators who understand the challenges of inventory, margins, and scale, our approach blends flexible funding with tools that deepen customer loyalty and drive meaningful revenue.

SMART CAPITAL FOR MODERN RETAIL,

DESIGNED WITH BRANDS IN MINDSMART CAPITAL FOR MODERN

RETAIL, DESIGNED

WITH BRANDS IN MIND

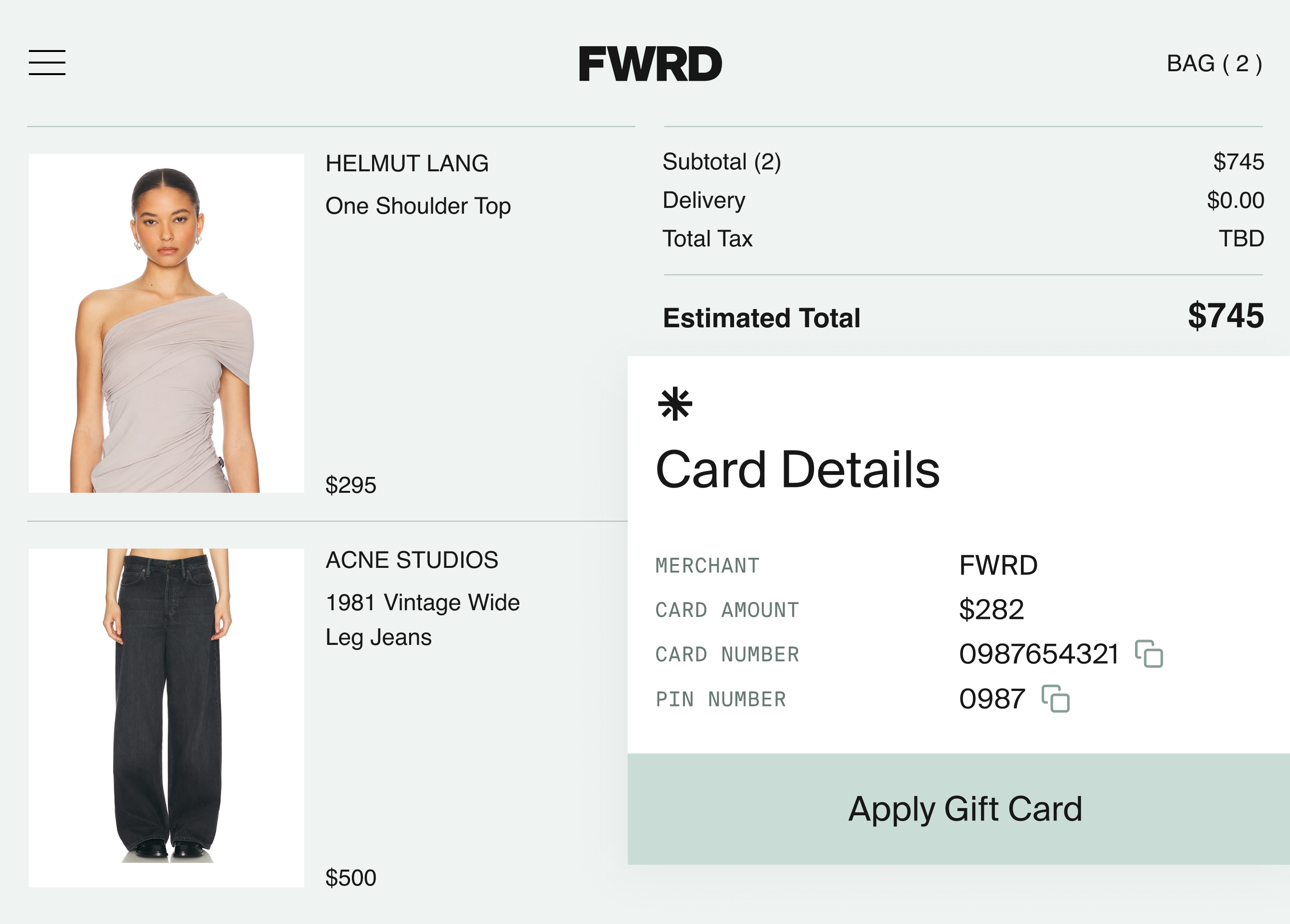

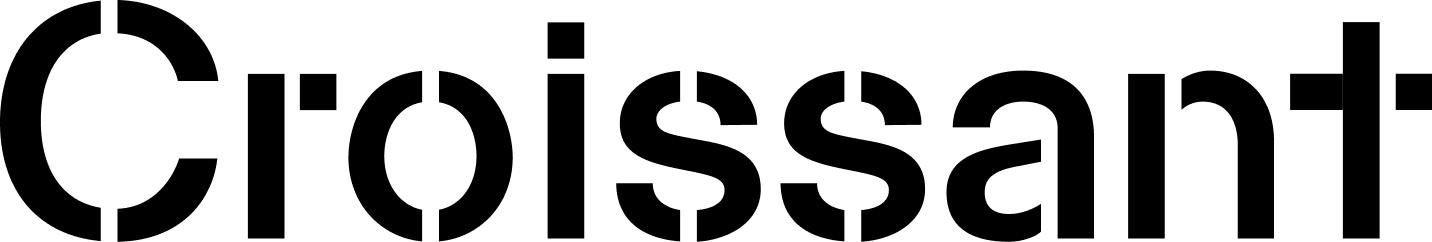

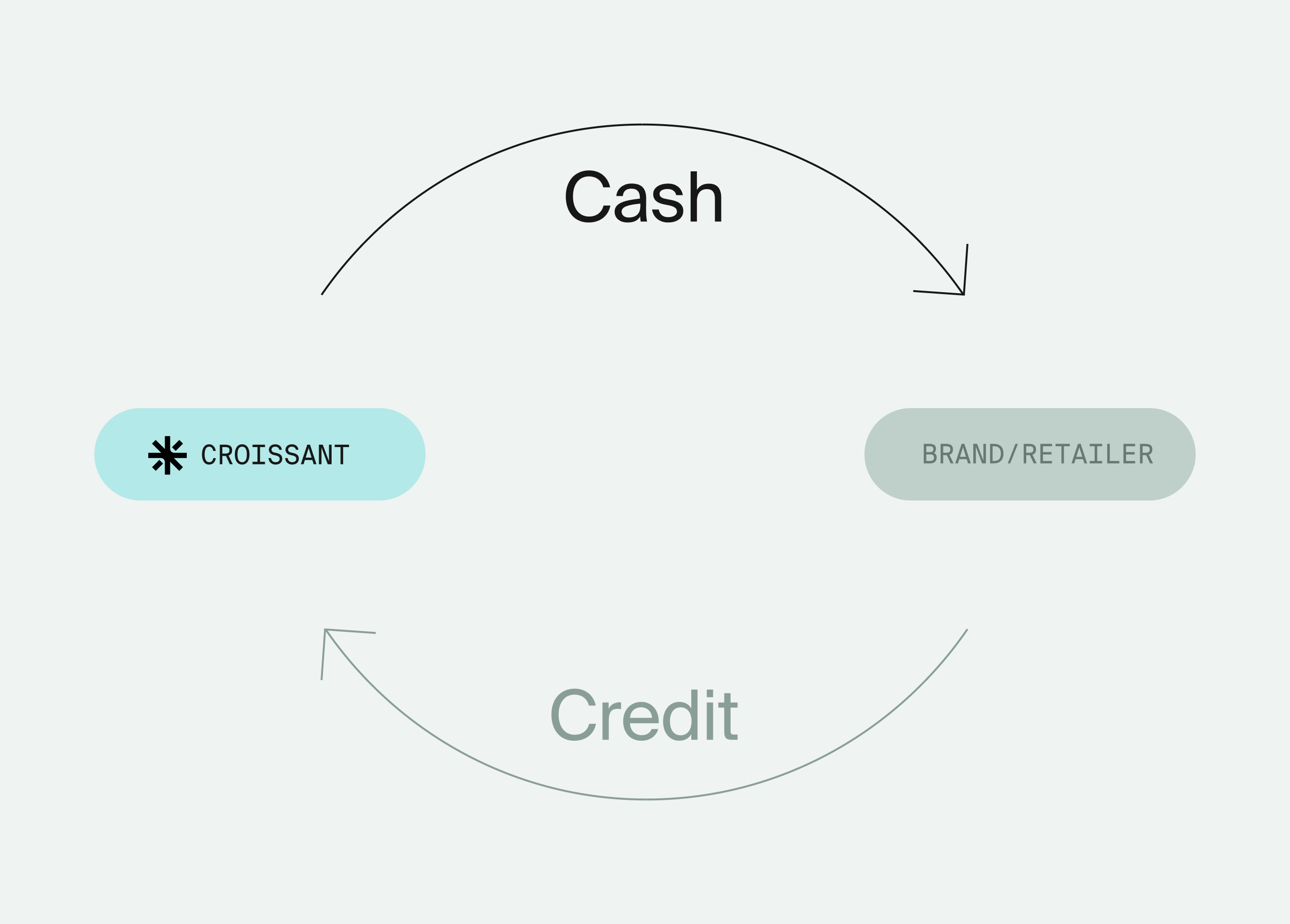

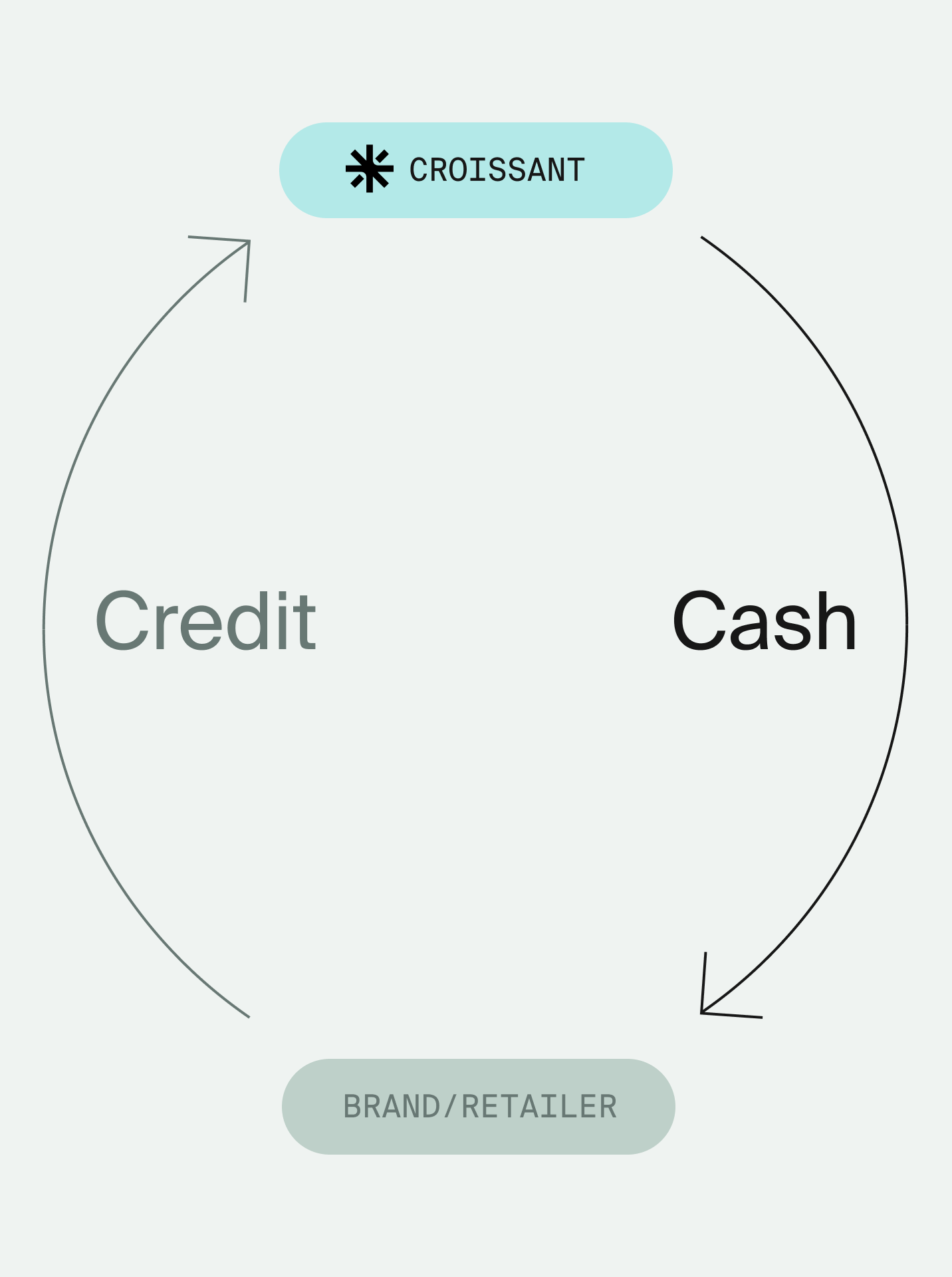

How it Works

Croissant purchases a large

amount of store credit.

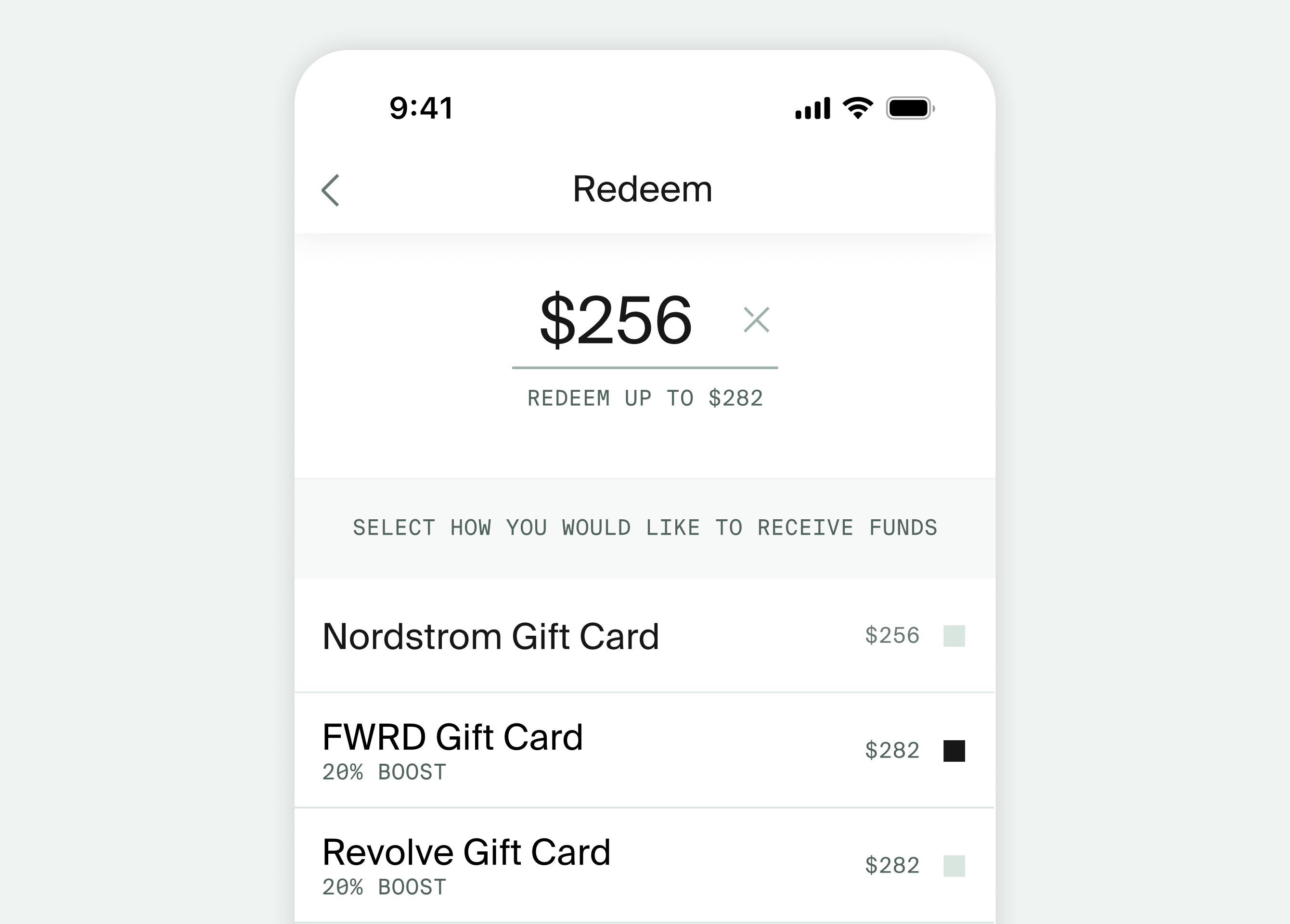

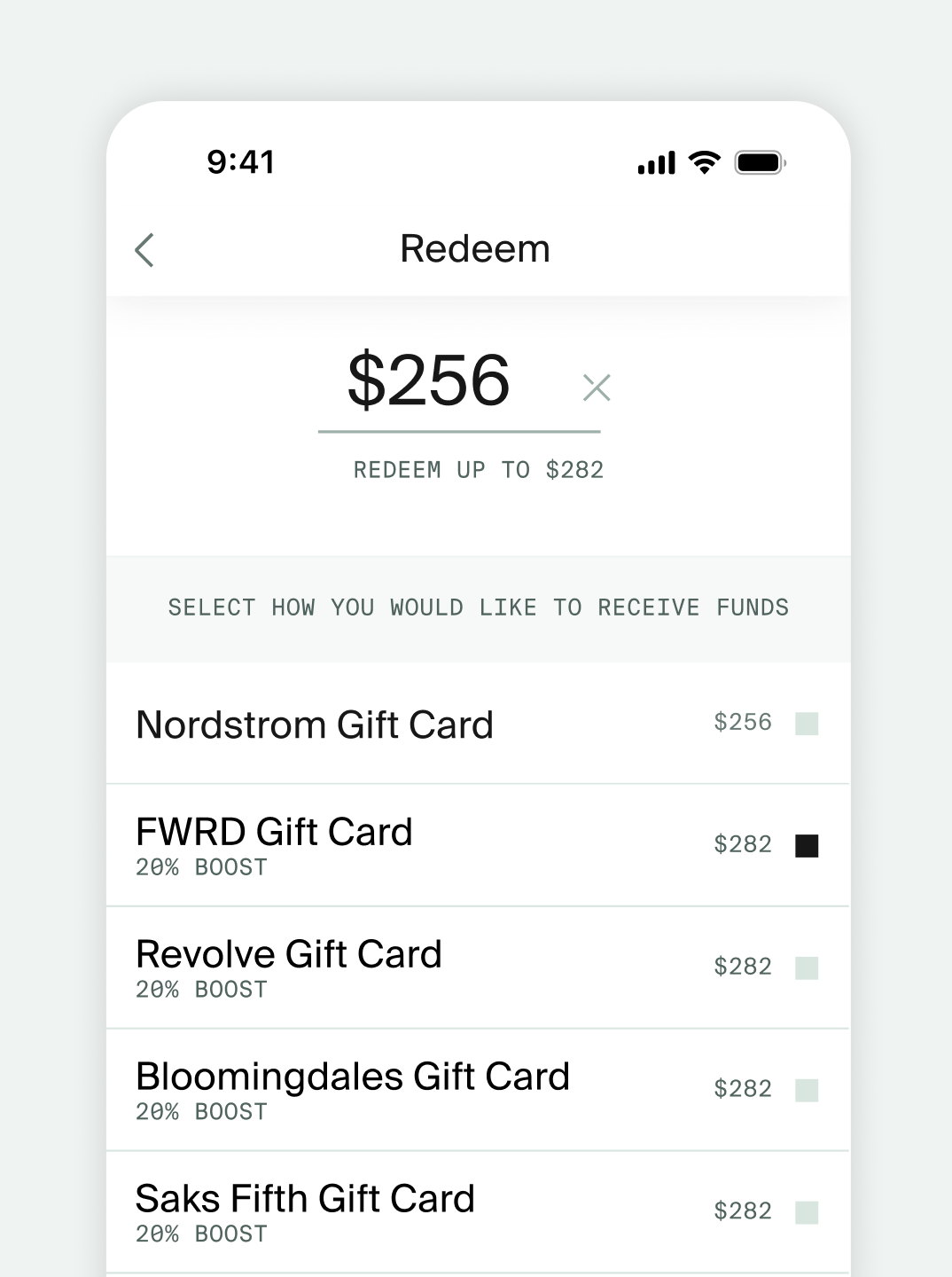

Croissant distributes store

credit to our user base via

resale payouts and boosted

credit packages.

Customers redeem credit,

spending 2.9x the credit

amount on average.